Is Forex Trading Profitable?

The foreign exchange market, commonly known as Forex, is a dynamic and fast-paced marketplace where currencies are traded. The allure of Forex trading has attracted countless investors due to its potential for high returns. In this article, we will delve into the aspects of profitability in Forex trading, examining the factors that influence success, and providing insight into whether it can be a viable source of income. To get started on your trading journey, you might want to check out is forex trading profitable Global Trading PK.

Understanding Forex Trading

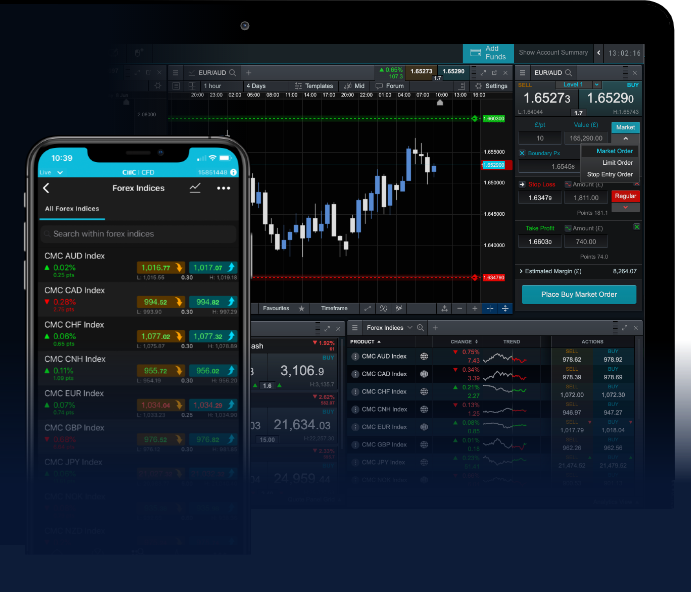

Forex trading involves buying one currency while simultaneously selling another. The currency pairs, such as EUR/USD or GBP/JPY, are what traders focus on. The Forex market operates 24 hours a day, five days a week, providing ample opportunities for traders to enter and exit positions at any time. Unlike stock markets, where trading is confined to specific hours, Forex trading allows for flexibility and continuous opportunities.

The Potential for Profit

One of the most attractive aspects of Forex trading is the potential for significant profit. Here are some key reasons why Forex trading can be profitable:

1. Leverage

Forex brokers often provide leverage, which allows traders to control a larger position than their initial investment. For example, with 100:1 leverage, a trader can control $100,000 with just a $1,000 margin. While leverage can amplify profits, it also increases the risk of significant losses, making risk management crucial.

2. High Liquidity

The Forex market is one of the most liquid markets in the world, with an average daily trading volume exceeding $6 trillion. This high liquidity means that traders can enter and exit positions quickly without significantly impacting the market price, allowing for easier execution of trades at desired prices.

3. Diverse Opportunities

With numerous currency pairs available, traders have access to a wide array of opportunities. Macro-economic factors, geopolitical events, and market sentiment can result in price fluctuations, allowing traders to capitalize on both rising and falling markets.

Challenges in Forex Trading

While Forex trading can be immensely profitable, it comes with its challenges:

1. Market Volatility

The Forex market can experience significant volatility, especially during major economic announcements or geopolitical events. Sudden price movements can lead to rapid gains or losses, making it essential for traders to be prepared for unpredictable changes.

2. Emotional Discipline

Many traders struggle with emotional decision-making, which can lead to poor trading choices. Overtrading, revenge trading, and fear of missing out (FOMO) can negatively impact profitability. Developing a disciplined approach, including sticking to a well-defined trading plan, is critical for long-term success.

3. Learning Curve

Forex trading requires an understanding of technical and fundamental analysis, making it essential for new traders to invest time in education and practice. Many traders face a steep learning curve before achieving consistent profitability.

Strategies for Success

To increase the chances of becoming a profitable Forex trader, consider the following strategies:

1. Create a Trading Plan

A solid trading plan outlines your goals, risk tolerance, and trading strategy. It should include entry and exit criteria, as well as guidelines for risk management. Sticking to your trading plan can help reduce the influence of emotions on your trading decisions.

2. Focus on Risk Management

Effective risk management is paramount in Forex trading. Use stop-loss orders to protect your capital and determine your risk-reward ratios before entering a trade. A common rule is to risk only 1-2% of your trading capital on any single trade.

3. Continuous Education

The Forex market is constantly evolving, and staying informed about economic indicators, market trends, and new trading techniques is essential. Take advantage of educational resources such as webinars, courses, and trading forums to enhance your knowledge.

Conclusion

In conclusion, Forex trading can be profitable, but it is not without its challenges. Success in the Forex market requires a combination of education, experience, and discipline. While the potential for substantial returns exists, new traders should approach the market with realistic expectations and a robust risk management strategy. Ultimately, whether Forex trading is profitable for you will depend on your dedication to learning, adapting to market changes, and adhering to a well-defined trading plan.